- BTC has logged adverse funding charges for the primary time this yr.

- On-chain knowledge exhibits elevated promoting as many exit buying and selling positions.

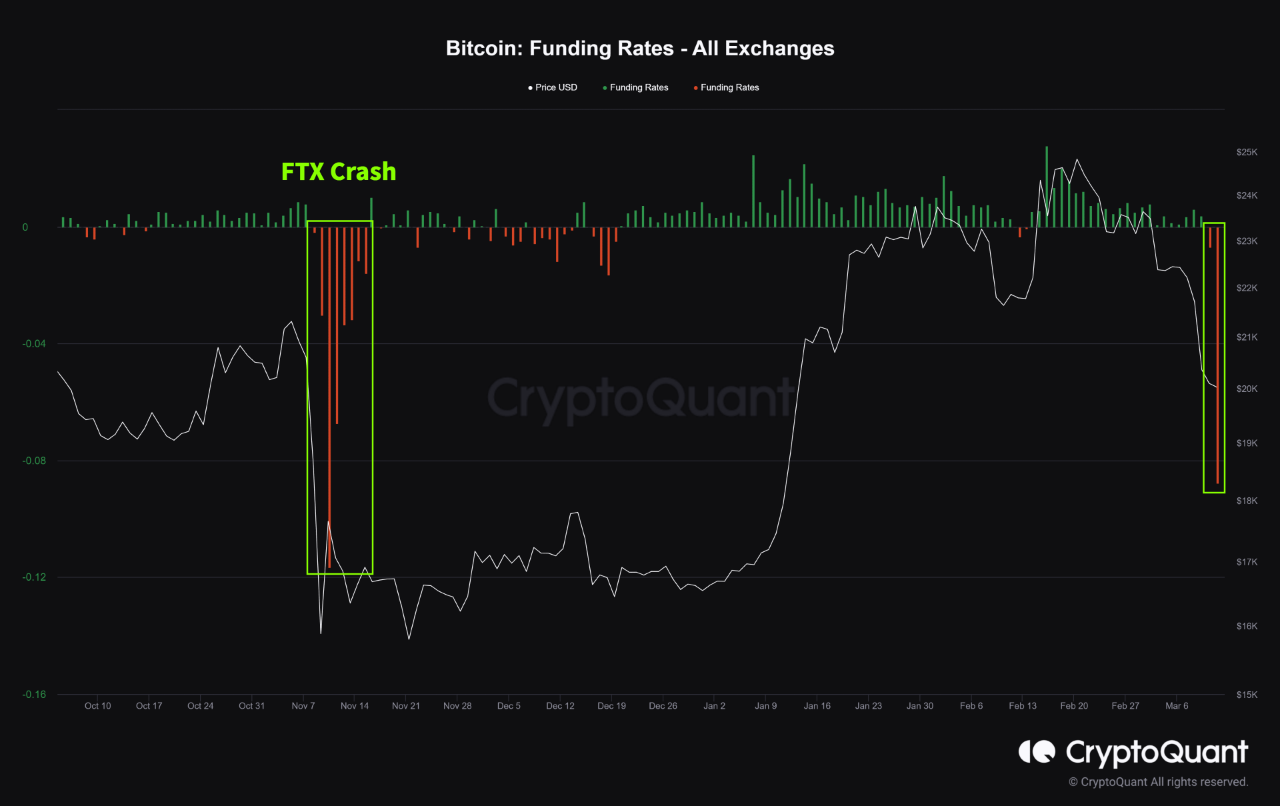

Because the cryptocurrency market grapples with the uncertainty that lies forward as banks resume operations on Monday, Bitcoin’s [BTC] funding charges turned adverse for the primary time for the reason that yr started, knowledge from CryptoQuant revealed.

The BTC market has been hit by adverse sentiments for the reason that Silicon Valley Financial institution saga started, in accordance with CryptoQuant’s Jay Bot. Consequently, funding charges turned adverse for the primary time this yr and have reached ranges just like these seen when FTX collapsed in November 2022.

Learn Bitcoin [BTC] Price Prediction 2023-24

Funding charges are the charges merchants pay to carry positions in futures markets. When the funding fee turns adverse, merchants are paying extra to carry lengthy positions than quick positions.

Jay Bot, nonetheless, opined:

“If unhealthy information disappears and Bitcoin costs rebound, a brief squeeze might happen because the overheated quick positions are liquidated.”

BTC bears take management as market sentiment turns bitter

An on-chain evaluation of BTC’s efficiency up to now this weekend confirmed the exit of buying and selling positions by traders.

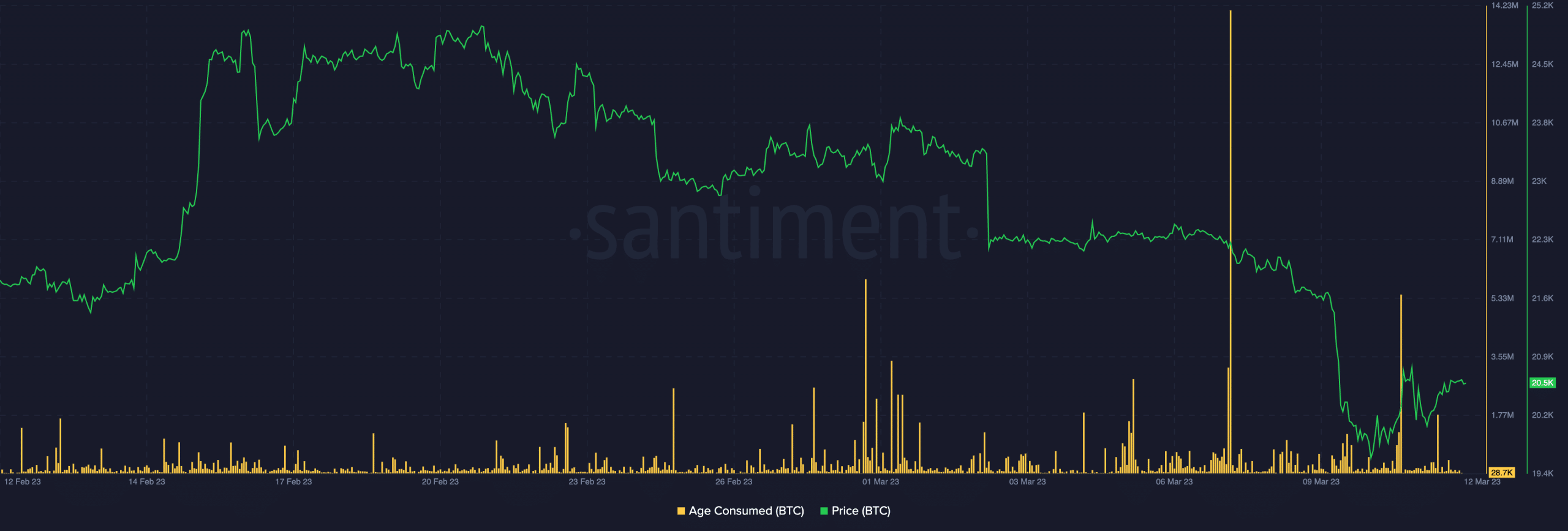

Information from Santiment revealed a spike in BTC’s Age Consumed metric within the early buying and selling hours of 11 March. Buyers’ confidence declined because the buying and selling day progressed, inflicting the worth of BTC to drop.

Is your portfolio inexperienced? Try the Bitcoin Profit Calculator

A spike in an asset’s Age Consumed metric signifies that many beforehand idle tokens at the moment are being transferred between addresses. This means that there was a sudden and powerful change within the conduct of long-term holders, who’re usually identified for making cautious choices.

HODLers and skilled merchants are identified for being deliberate of their actions, which is why the elevated exercise of dormant cash usually coincides with main shifts in market situations.

Moreso, a spike in Age Consumed adopted by a worth drawdown, as is the case right here, marks the formation of an area prime, which frequently marks the start of a interval of worth decline.

Moreover, as BTC’s worth dropped on 11 March, its Trade Influx rallied, per knowledge from Santiment.

Usually, a rise within the variety of cash shifting to identified change wallets simply earlier than an area prime can point out a widespread sell-off.

Generally, this sell-off could also be too sudden and important for the bulls to handle. Nevertheless, this has been nothing out of the unusual in BTC’s case.