Government abstract: Regardless of China’s ban on crypto operations, Hong Kong is positioning itself as a regional crypto and Web3 hub, attracting blockchain companies and legalizing retail cryptocurrency buying and selling. With a sturdy regulatory framework in place, Hong Kong has already obtained expressions of curiosity from over 80 firms offering crypto-related providers.

Bitcoin (BTC) and Ethereum (ETH) are anticipated to be the chief beneficiaries, however rising Web3 providers additionally warrant consideration. Traders ought to monitor the evolving regulatory panorama and observe mainland China’s strikes, as loosening crypto restrictions might trigger the market to surge.

China’s Evolving Stance on Crypto

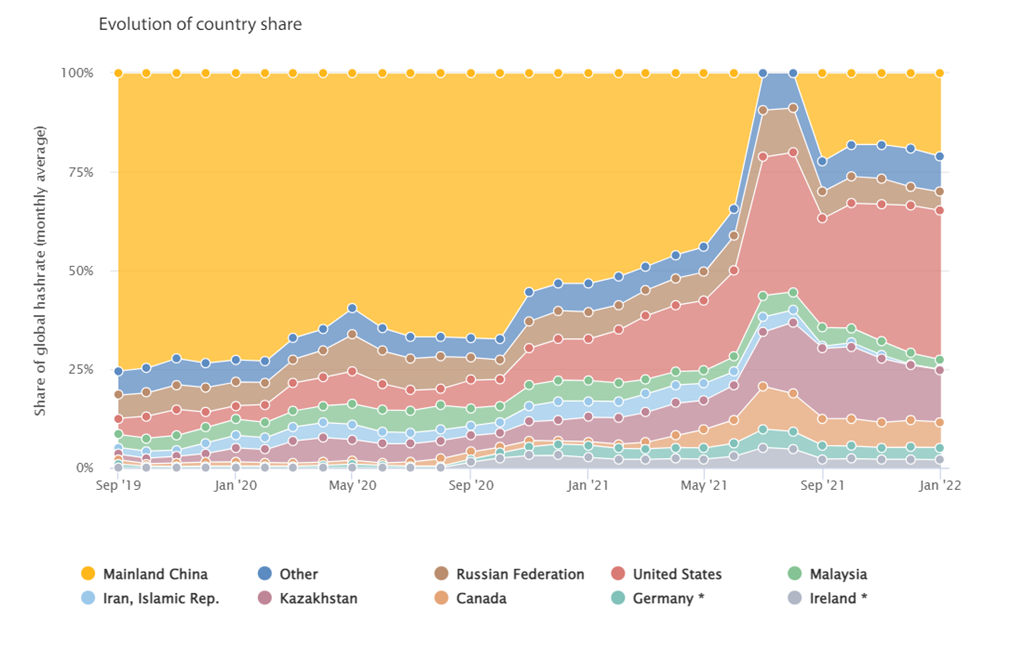

In the course of the preliminary years of bitcoin’s existence, China was probably the most necessary international locations for the crypto trade, because it hosted many firms working trade platforms, wallets, and different providers. Furthermore, China alone accounted for about two-thirds of all bitcoin mining in 2019-2020.

Nevertheless, the Chinese language authorities subsequently determined bitcoin and different cryptocurrencies pose many dangers that outweigh the potential advantages. The outcome was Chinese language authorities steadily cracking down on all retail crypto operations.

In 2017, it began with preliminary coin choices (ICOs). The federal government shut down all ICO platforms and operations once they have been at their peak. If a neighborhood trade bought ICO tokens, they needed to return the funds to buyers.

Throughout that point, China cracked down on many crypto exchanges, however the countrywide ban got here in 2021. As bitcoin skyrocketed to contemporary information, China banned crypto mining and prohibited all crypto transactions altogether, forcing mining and trade firms to relocate.

Hong Kong as an Experiment

Regardless that Hong Kong is formally a part of China, it stays considerably separate resulting from its standing as a particular administrative area (SAR). This standing provides town extra freedom; thus it’d select to not implement Beijing’s crypto guidelines. Because of the proximity to the mainland territory, many crypto firms may relocate to Hong Kong looking for higher circumstances.

The excellent news is that Hong Kong plans to grow to be a regional crypto and Web3 hub and even compete with Singapore to draw blockchain companies, particularly after Singapore moved to a tough stance on crypto companies final yr. Crucially, Hong Kong has reportedly obtained the nod from Beijing.

On the finish of 2022, Hong Kong said throughout its government-backed fintech week occasion that it deliberate to legalize cryptocurrency retail buying and selling and develop a licensing system for crypto exchanges and different blockchain firms.

Some imagine that China will intently monitor Hong Kong’s crypto story earlier than returning to the crypto query itself.

Deng Chao, CEO of digital asset supervisor Hashkey Capital, commented on Hong Kong’s crypto initiative:

“Sooner or later, it might function a mannequin for coverage formulation in different areas [in China] if it proves profitable.”

Sturdy Regulation Anticipated

As Hong Kong prepares to grow to be crypto-friendly, it’s creating an intensive regulatory framework for digital belongings and blockchain operations. In February 2023, town’s Securities and Futures Fee (SFC) released draft guidelines enabling buyers to commerce sure main cryptocurrencies beginning June 1, 2023. Nevertheless, it didn’t point out which cash could be supported.

The monetary regulator plans to introduce a brand new licensing regime to take impact on June 1. The brand new guidelines would require all centralized crypto exchanges doing enterprise in Hong Kong to be licensed by the SFC. The regulatory necessities are anticipated to be much like these for licensed securities brokers and automatic buying and selling venues.

SFC CEO Julia Leung acknowledged:

“In mild of the latest turmoil and the collapse of some main crypto buying and selling platforms all over the world, there may be clear consensus amongst regulators globally for regulation within the digital asset area to make sure buyers are adequately protected and key dangers are successfully managed.”

Who’s ?

In February, town’s Division for International Direct Funding obtained “expressions of interest” from greater than 80 firms providing crypto-related providers. The businesses, situated in mainland China and overseas, embrace crypto exchanges, blockchain infrastructure companies, blockchain community safety companies, crypto wallets and cost operators, and different Web3 firms.

KuCoin, one of many largest crypto exchanges by buying and selling quantity, acknowledged final yr that it will open an workplace in Hong Kong. Different main firms planning to increase their presence within the metropolis are Huobi, OKX, and Gate.io.

Apparently, crypto companies have discovered an surprising ally: Chinese language state-owned banks. Bloomberg cited individuals acquainted with the matter saying that Chinese language banks, together with Shanghai Pudong Improvement Financial institution (600000:CH), the Financial institution of Communications Co. (BKFCF:US), and Financial institution of China Ltd. (3988:HK), have both began offering banking providers to crypto firms in Hong Kong or made inquiries with crypto companies.

Institutional buyers are additionally monitoring Hong Kong’s transformation into a possible crypto hub, trying to grow to be early beneficiaries within the competitors to win market share.

Which Tokens May Profit Most?

Hong Kong is about to shortlist the cryptocurrencies to be accepted for buying and selling beginning on June 1. Whereas it hasn’t indicated which digital belongings could be accepted, the listing will seemingly embrace bitcoin (BTC) and Ethereum (ETH), which is able to in all probability stay the first beneficiaries.

Ethereum generally is a main winner as Hong Kong has prompt it plans to grow to be a Web3 hub. Nearly all of decentralized functions (dapps), non-fungible tokens (NFTs), and different Web3 parts depend on Ethereum as their underlying infrastructure.

By way of at the moment standard dapps within the Asian area, the decentralized exchange 1inch (INCH) continues to see nice curiosity. By way of centralized exchanges, leaders embrace Binance (BNB) and Kucoin (KCS), together with OKX.

One other potential profitable blockchain will probably be Polygon (MATIC). This ties into the recognition of gaming in Asia typically and in China particularly. Based on a DappRadar study, Polygon is the favored blockchain for sport improvement, with 30.8% of internet studio sport builders selecting Polygon. That is necessary, as a result of Asia has 55% of the full international avid gamers, representing some 1.7 billion customers.

In China gaming is dominated by Tencent (TCEHY:US), and whereas the corporate isn’t at the moment growing blockchain video games, it has just lately introduced quite a lot of partnerships that point out it might be transferring into the blockchain area in response to the information. Tencent will collectively develop a collection of blockchain API providers with Web3 infrastructure supplier Ankr (ANKR), and can be partnering with a number of Web3 infrastructure builders, together with Avalanche (AVAX), Scroll, a Layer-2 scaling resolution for Ethereum; and Sui (SUI), a comparatively younger Layer-1 blockchain created by ex-Meta staff.

Can Hong Kong Grow to be a Crypto Hub?

Regardless of the strict laws anticipated, the Hong Kong crypto hub plan has all stipulations to grow to be a actuality. Town’s initiative is turning into much more related at this time because the US, till just lately top-of-the-line jurisdictions for crypto companies, has been cracking down on crypto operations in response to the collapse of FTX.

Coinbase, the most important crypto trade within the US, is contemplating relocating resulting from “regulatory uncertainty.” As we will see, the dearth of clear regulation generally is a downside. It stays to be seen how restrictive Hong Kong goes to be.

Investor Takeaway

As Hong Kong takes steps to grow to be a crypto and Web3 hub, buyers ought to hold an in depth eye on the evolving regulatory panorama and the potential impression on the crypto area. It is smart to watch the listing of accepted tokens when it turns into public and the extent of help from mainland China. If the latter begins loosening its crypto ban, the market will seemingly explode.

Bitcoin (BTC) and Ethereum (ETH) are anticipated to be the foremost beneficiaries, however rising Web3 providers deserve consideration as properly.

Over 50,000 crypto buyers get our Bitcoin Market Journal e-newsletter. Click to subscribe and be a part of the tribe.