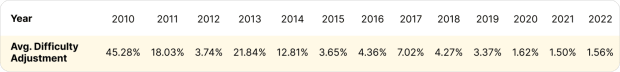

Since Bitcoin’s inception, community difficulty has grown from 1 to as a lot as 48.71 trillion hashes {that a} miner would theoretically have to generate to search out the profitable one. This implies it’s 48.71 trillion instances more durable to mine a Bitcoin block at this time than when mining first started in 2009 — a compound enhance of 20.64% per thirty days.

On the time of this writing, Bitcoin’s problem is at an all-time excessive, which implies that miners — on a BTC foundation — are making much less in rewards per unit of hash fee than ever earlier than. Subsequent to bitcoin’s value, Bitcoin’s problem is a main issue that influences hash price (mining revenue per unit of hash rate), so miners are enthusiastic about projecting Bitcoin’s hash rate progress and problem developments for enterprise planning.

To this finish, miners and Bitcoiners devised the constant-block-time technique for estimating upcoming changes, however this technique sometimes over or underneath estimates problem modifications in the beginning of every problem epoch.

To enhance on this, the group at Luxor Applied sciences developed a brand new technique referred to as the “rolling-block technique,” which we describe in additional element in a recent report on forecasting Bitcoin mining difficulty.

It’s our hope that the rolling-block technique for forecasting Bitcoin problem might present miners, traders and hash fee merchants a greater device to plan for problem modifications

Luxor’s ‘Rolling Block Methodology’ For Forecasting Problem Changes

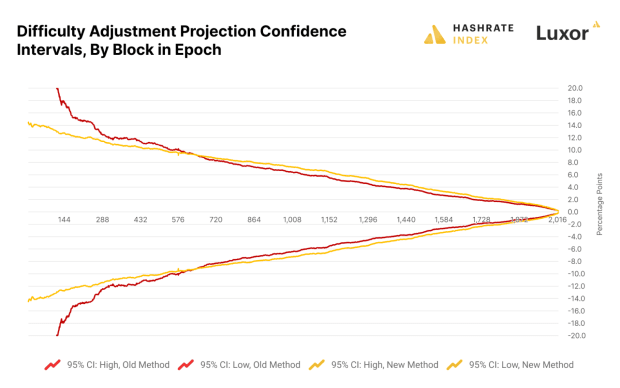

For this report, we developed a brand new time sequence forecasting technique for upcoming problem changes, which improves accuracy in the beginning of the epoch in comparison with the fixed block time technique. We name this the succinctly-named “rolling-2,015-block, square-root-weighted, epoch-adjusted block time technique” (or simply “rolling-block technique,” “adjusted-block-time technique,” or “dual-epoch technique”).

This new technique improves upon the constant-block-time technique early within the epoch by together with block instances from the earlier 2,015 blocks, as an alternative of simply the blocks from the present epoch, which might skew forecasts early within the epoch for lack of knowledge factors. To account for the change in community problem between epochs, block instances within the earlier epoch are adjusted by the earlier adjustment. And eventually, we weight the common block instances of the present epoch with the sq. of the proportion by way of the epoch. This ultimate step is to decrease the affect of block instances from the earlier epoch as the present epoch progresses since these values don’t really decide the upcoming adjustment.

Within the chart under, we are able to see by way of confidence intervals that the brand new technique carried out higher than the previous mannequin in the beginning of the epoch as much as block 650, however it carried out barely extra poorly thereafter:

This forecast, after all, is just for projecting the following problem adjustment. What if we wished to forecast, say, a yr into the long run?

Lengthy-Time period Bitcoin Mining Problem Forecasting

Luxor has developed models for long-term difficulty forecasting, as nicely, however these fashions are clearly far more advanced, since they span an extended time-frame.

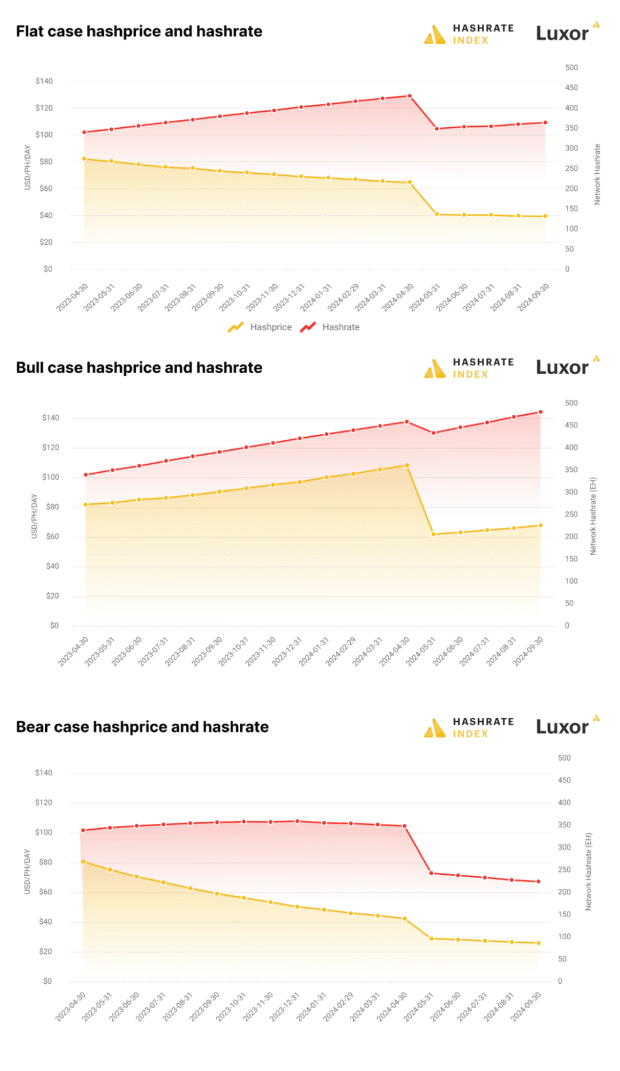

Our mannequin takes the bitcoin value, transaction charges and block subsidy as inputs on the demand aspect, and inside information on ASIC manufacturing estimates and working value distributions throughout the trade on the provision aspect. Utilizing these inputs, the mannequin produces an equilibrium hash fee, problem and hash value for 18-month intervals.

The mannequin construction displays actuality; hash fee, problem and hash value are endogenous to the system, not exogenous determinants of each other. We will conduct sensitivity analyses with the mannequin throughout all inputs as nicely. For instance, we are able to forecast an equilibrium hash fee, problem, and hash value throughout a spread of bitcoin costs.

The charts under current projections from our up to date hash fee provide and demand mannequin. It offers estimates for flat, bull and bear bitcoin value situations.

Hash Fee, Problem And Hash Value Projection Updates

Hash fee is an rising asset class and digital commodity market. Hash fee market individuals like Bitcoin miners, hosters, lenders, traders and merchants want entry to the rigorous financial evaluation and information accessible in different commodity markets.

Luxor can be dedicated to offering this evaluation and forecasting on a quarterly foundation. In the event you’d wish to study extra, please visit this post.

This can be a visitor publish by Colin Harper. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.